As Mr. Trump keeps up his rhetoric on tariffs, talk north of the border, is increasingly about oil pipelines. Briefly, the idea is to diversify Alberta’s oil exports by building pipelines to the ocean, where oil tankers could in theory take the oil anywhere. This idea runs into two practical problems: Cost of building the pipelines, and declining demand in potential markets. What may be a good idea today, could be tomorrows rather expensive white elephant.

Lets start with some basics. Below is a table showing three long distance pipelines in Canada. The Trans-mountain to the port of Vancouver (#1, in blue), the key-stone pipeline (#9 in yellow), and the Embridge Canadian Mainline (number 4, in red). The Canadian Mainline, is the biggest by capacity 2890 thousand barrels per day (bpd), it dips into the US (becoming the Lakehead System), as it makes its way from Edmondon, Alberta, through Saskatcewan, Manitoba, eventually reaching Chicago before turning back towards Canada, and winding up in Sarnia Ontario, where other pipelines take Alberta’s finest onwards to Quebec.

Looking at the Canadian energy regulator website (source), and Wikipedia (source), we can fill in the following table outlining some of the pipelines in the figure above.

| Pipeline | Length [km] | Year completed | Toll [$CAD/Barrel | Capacity [Thousand barrels/day] |

| Embridge Line 9 | 853 | 1976 | 2 | 300 |

| Embridge Canadian mainline + US Lakehead system | 2306+3057 = 5363 | 1950-1957 | 9.09 | 2890 |

| Trans-mountain | 1492 | 2024 | 10 | 890 |

With that, what might future pipelines look like? Which markets might they serve? Given the current political climate, the goal is presumably to get oil to some other markets than the United States. In which case, the Pacific makes a lot more sense as a destination than the Atlantic. For two main reasons: Its a lot shorter (1500 km, vs perhaps 4000 km), plus European markets are in structural decline (source). The second argument is perhaps the most important, as European markets might be well served with existing suppliers.

The recently completed Trans-mountain pipeline expansion is however, not overly encouraging. It cost whopping $32B to build, resulting in triple the transport tolls ($10 per barrel for 1500 km of transport). You still need to fork over a toonie or so to get that oil on a tanker bound for say China (source). Those tolls seem rather high, given the $80 CAD or so, cost for that barrel. For comparison, you could buy a slightly higher quality oil barrel in Texas for $100 (Alberta’s finest has higher sulfur content than Texan oil, (source)), and only spend a dollar to ship it on a mega tanker from Texas to China (source). Hence, the economics are shaky, even at those “high” tolls, the project will never stand financially on its own, and thus smells a lot like a $32B subsidy to the oil industry (source).

So, I hear you my dear reader, you might say, “the environmentalists killed the trans-mountain pipeline” (source). Fair enough, I ought to behave, and provide a second example. Enter the Coastal Gas-link, a 670 km natural gas pipeline from Dawson Creek, BC to Kitimat, BC. It fared no better. It cost $15B to build (source), and there was plenty of drama during its 5 year construction (source). On a per km basis, the two projects are very similar (~ $21M/km for Transmountain, vs. $22M/km for coastal Gas-link). Just because its shorter, the tolls may be a bit more reasonable. But for future pipelines, the per-km pricetag is very high.

Thus I do not believe that the proposed Northern-Gateway pipeline would fare any better, mostly as the length is actually slightly longer than the trans-mountain pipeline, with its decade long construction trauma.

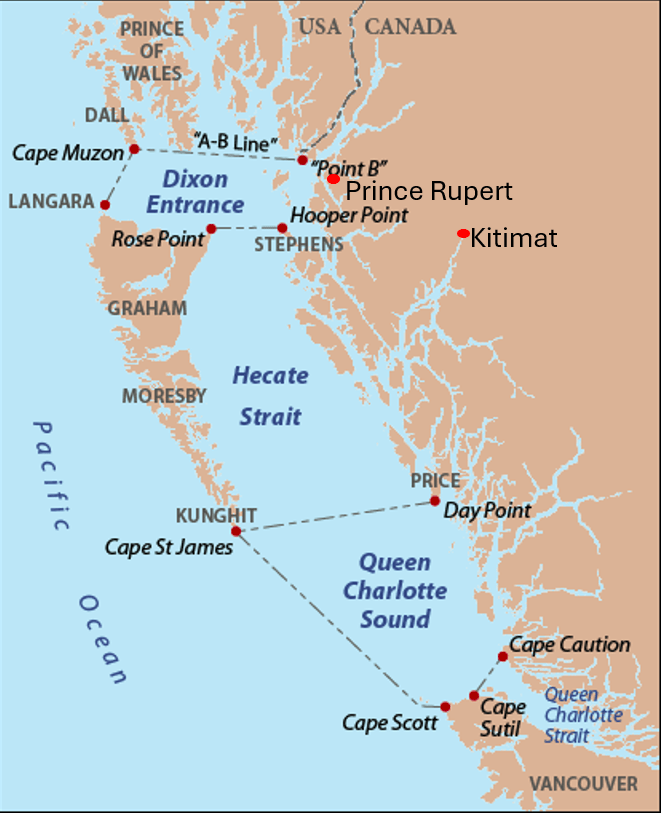

There is also the matter of the British Columbia Tanker moratorium, as shown on the map below, its hard to sail a Tanker to either Prince Rupert, BC or Kitimat, BC without having to go through waters included in the BC tanker moratorium.

If the idea is to load oil onto Tankers, why not do so in Thunder Bay ON? After all, the original Canadian Mainline pipeline took oil from Edmonton to Superior WI, where it was loaded onto Tankers for shipment to Sarnia, ON and beyond (source). That idea might work, as Gretna, MB (where the Canadian Mainline pipeline enters the US), is about 800 km from Thunder Bay, ON, a manageable distance, and a doable project, albeit perhaps one with a $16B price tag. There is also the minor detail that the great lakes freeze over in Winter, but you could ship from May to November each year, with reasonable economics. Your tankers might even cross the Atlantic and serve new markets in Africa, India and South America.

Whatever you do, its hard to see new export capacity offering lower tolls than the CAD $10 per barrel being offered by Transmountain. This may not seem like much, but keep in mind that at the time of this writing (May 2025), global oil prices are on a downward trend lately (source), and at $90 CAD/barrel, that $10 toll is going to hurt.

Further, you have to think of the world in 2035 and beyond when considering such projects. After all, the Northern Gateway would come online in 2035, and you are betting on 30-50 years of “good tolls” to pay for it. Thus ideally, oil demand would continue to climb and show great increases from 2035 through to 2085. The global oil demand forecast charts at the international energy agency are not encouraging, all scenarios provided show global oil demand on a downward trend from 2032 and onwards (source).

For sure, I am no business expert, but to spend $30B+ on a project with no growth potential and questionable economics even if it does work seems like very poor policy to me. Better spend that on other projects with potential to go somewhere and do something.