Historically, Texas based refineries switched from Venezuelan oil to Canada’s finest as Venezuelan politics became less and less stable (source). Naturally, the thinking goes, with Venezuela “back-in-the-game” Texas refineries might turn their backs on Canada’s finest. Thus, according to Mr. Polievre, we ought to build a second pipeline to the pacific pronto. There are two problems: Demand for oil in the Asia-Pacfic region may not be there, and most of Ablerta’s prudction goes to refiners in the Midwest, not Texas. Lets explore this further.

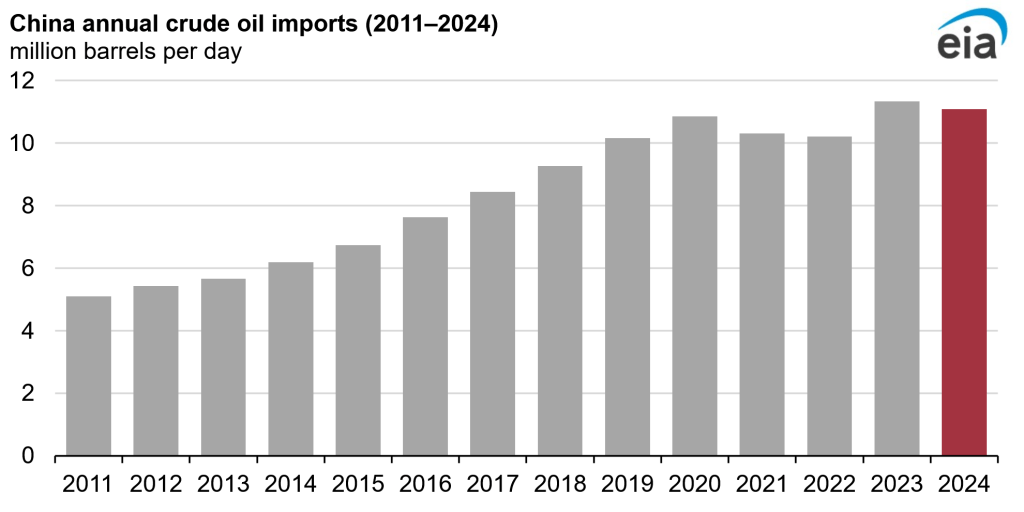

According the US energy information administration, China’s oil imports have been plateoing since the pandemic, while 2023 was a record year, oil imports into China have not increased all that much since 2019 (10 MBpd in 2019 to 11.1 MBpd in 2024, about 10% growth in 5 years). Two forecasters predict this will continue into the 2030’s with sluggish if any growth in China’s oil imports (source and source).

Well if China does not need any more oil, how about the worlds most populus country India? Well, there is at least some growth, the international energy agency (IEA), expects about 3% annual growth in oil consumption in India into the 2030s (source). But admitedly from a base that is about half of China at about 5.7 MB/day in 2024. Japan? Korea?, falling oil demand in Japan from a peak of 5.7 MB/day to 3.3 MB/day in 2023 (source). Korea, steady at 2.8 MB/day. So, mostly steady, perhaps some growth in oil imports throughout Asia? Not exactly the growing market a new entrant would need to flourish in.

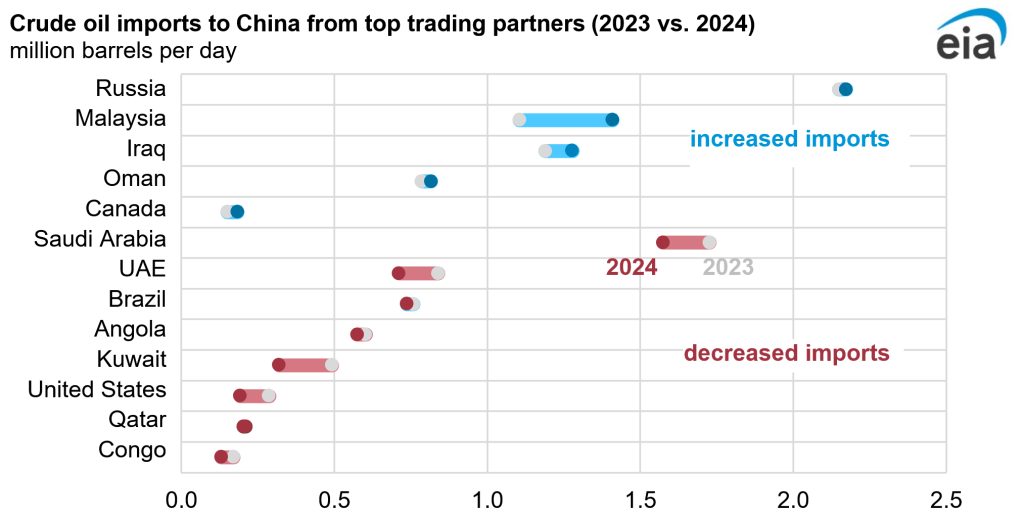

There is also loads of competition. Take for example where China gets its 11.1 MB/day from (source). While Canada gets into the “increasing” imports column, Saudi/UAE/Kuwait and other big oil producers sent less oil to China in 2024 than 2023. The gulf countries do not need to content with big mountains, or enviromental oposition to export their oil. In fact Saudi Arabia has been adding solar capacity at an impressive pace (source), suggesting they could probably export more crude.

Indeed, the IEA predicts Saudi Arabia alone could bump production and exports to 12 MB/Day from their current 10 MB/Day (source). Surely the Russians and the Ukrainians will stop killing each other at some point as we head into the 2030s, this could bump Russian oil back onto the market, further increasing competition.

There might be some short term moves, for example, Venezuela’s crude is quite simlar to Alberta’s finest, hence if the US starts gobbling up Venezuelian crude, China will need 1 MB/day from somewhere else (source), perhaps Alberta? Perhaps some smaller markets in Asia will discover a thirst for Canada’s finest, or some geopolitical folly upend existing suppliers.

Whatever the future will bring, oil demand in the Asia pacific region seems unlikely to dramatically increase, there is also loads of competition, and the heavily discounted $11/Barrel toll to use the TransMountain pipeline (source), really adds to the cost of something that currently goes for $50/Barrel (source), and we still need to ship it from Vancouver to Asia, further adding costs.

Besides, Texas gulf coast refiners only take about 10% of Canadian crude (source), most of Canada’s exports is pipelined to refineries in the midwest. If these refiners, who use 80-90% of Canadian exports, wanted to switch to Venezuelan crude, they would face the same pipeline problems Canadian crude is faced with, after all the Keystone XL pipeline that was supposed to aleviate this problem, got cancelled (source).

Given a stable or perhaps shrinking oil demand in Asia, lots of competition, and high costs. Canadian oil seems ill placed to serve Asia’s oil demands. Sure, there might be some short-term opportunities, but Canadian oil is not particularly competitive in the Asian market. Hence building another pipeline, and spend perhaps $30-50 B doing so, seems to be a poor use of limited public funds.